Ready to Secure your Financial Future?

Take the first step towards a peaceful retirement with our complimentary comprehensive financial plan. Here's what you can expect

By clicking the button, you'll be guided through a process that will provide valuable insights into your financial future. Our advisors will review your plan and offer personalized recommendations to help you retire with confidence.

Why Choose Us?

Striving to Meet Your Investment Needs

With years of experience and a dedication to your financial well-being, our firm aims to craft investment strategies tailored to your individual goals. We are committed to transparency, integrity, and maintaining a strong client focus. Our mission is to provide you with insights and strategies that may help you make informed financial decisions as you work towards building your financial future.

INSIGHTS AND SUPPORT

Comprehensive Guidance Through Every Step

Trust

We lead with trust and understanding. Your goals drive every recommendation, and our approach is always tailored—not templated.

Integrity

As a fully independent firm, we are free from sales quotas or product pushes. Our only commitment is to your financial success.

Transparency

We simplify the complex. You’ll always know what we’re doing, why we’re doing it, and how it benefits your long-term financial picture.

Focused on Your Financial Future

OUR SERVICES

Connect with a dedicated financial expert who takes the time to understand your unique goals.

Business Services

Net Financial offers small business financial services, ranging from 401(k) plans to business legacy planning.

Personalized Portfolios

We build investment portfolios tailored to your goals, risk tolerance, and time horizon, ensuring your strategy aligns with what matters most to you.

Estate Planning

Protect your legacy with thoughtful estate strategies that help preserve wealth, minimize taxes, and ensure your wishes are carried out.

Retirement Planning

Prepare for the future with a retirement plan designed to provide lasting income, financial security, and peace of mind throughout your retirement years.

Tax Planning

Maximize your earnings and reduce liabilities with proactive, tax-efficient strategies that support your long-term financial goals.

Wealth Protection

Safeguard your assets with customized solutions like insurance, annuities, and risk management strategies built to shield your financial future.

READY TO GIVE US A TRY?

Get Started for Free Today!

Meet our Expert Advisors!

Our advisors stay up-to-date with the latest market trends and economic developments to ensure that your portfolio remains adaptive and responsive to changes. Trust in the expertise and dedication of our team as we partner with you on your journey towards financial prosperity.

Contact Us

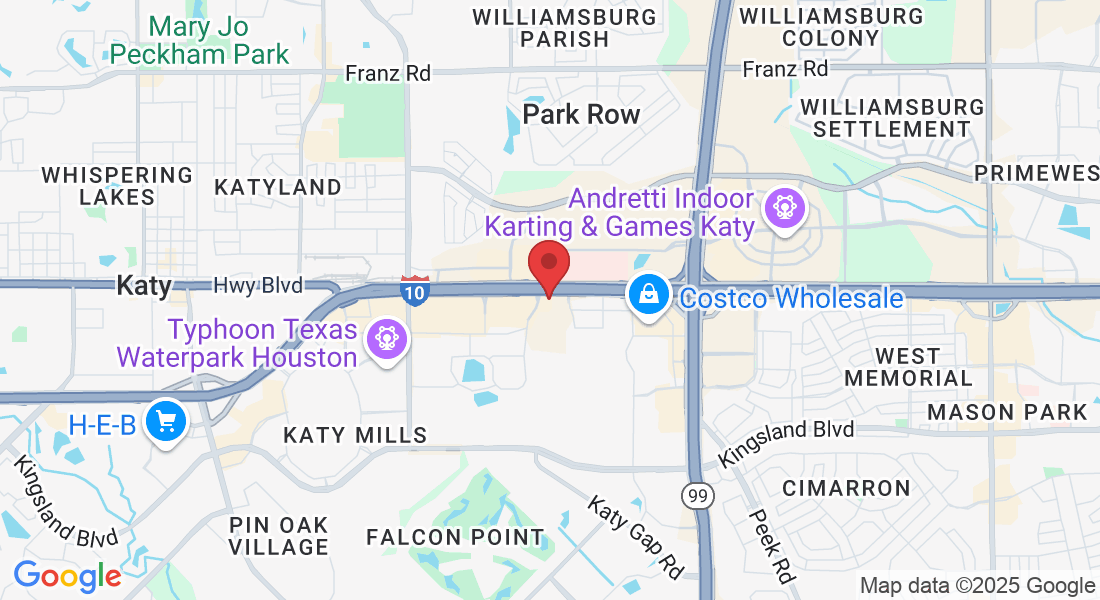

Net Financial Headquarters

24285 Katy Freeway, Suite 300

Katy, Texas 77494

Email: [email protected]

Phone: (346) 258-6100

Digitas Global, LLC dba Net Financial is a registered investment adviser with the Texas State Securities Board. Registration does not imply a certain level of skill or training. A copy of our current Form ADV Part 2A (Firm Brochure) discussing our advisory services, fees, and other important information is available upon request or at the SEC's investment adviser public information website www.adviserinfo.sec.gov. As a registered investment adviser, Digitas Global, LLC dba Net Financial has a fiduciary duty to act in the best interests of our clients at all times. Our fee structure is based on a percentage of assets under management. Detailed fee information is available in our Form ADV Part 2A. Past performance does not guarantee future results. All investments involve risk, including the potential loss of principal.

Net Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. The information provided on this website is for general informational purposes only and should not be construed as personalized investment advice. Consult with a qualified financial advisor before making any investment decisions. Our firm has adopted a Code of Ethics to ensure we uphold our fiduciary duty to our clients. A copy is available upon request. Information about any disciplinary history for our firm can be found at the SEC's investment adviser public information website www.adviserinfo.sec.gov.

Contact Information:

Digitas Global, LLC dba Net Financial

24285 Katy Freeway, Suite 300, Katy, Texas 77494

Email: [email protected]

Phone: (346) 258-6100